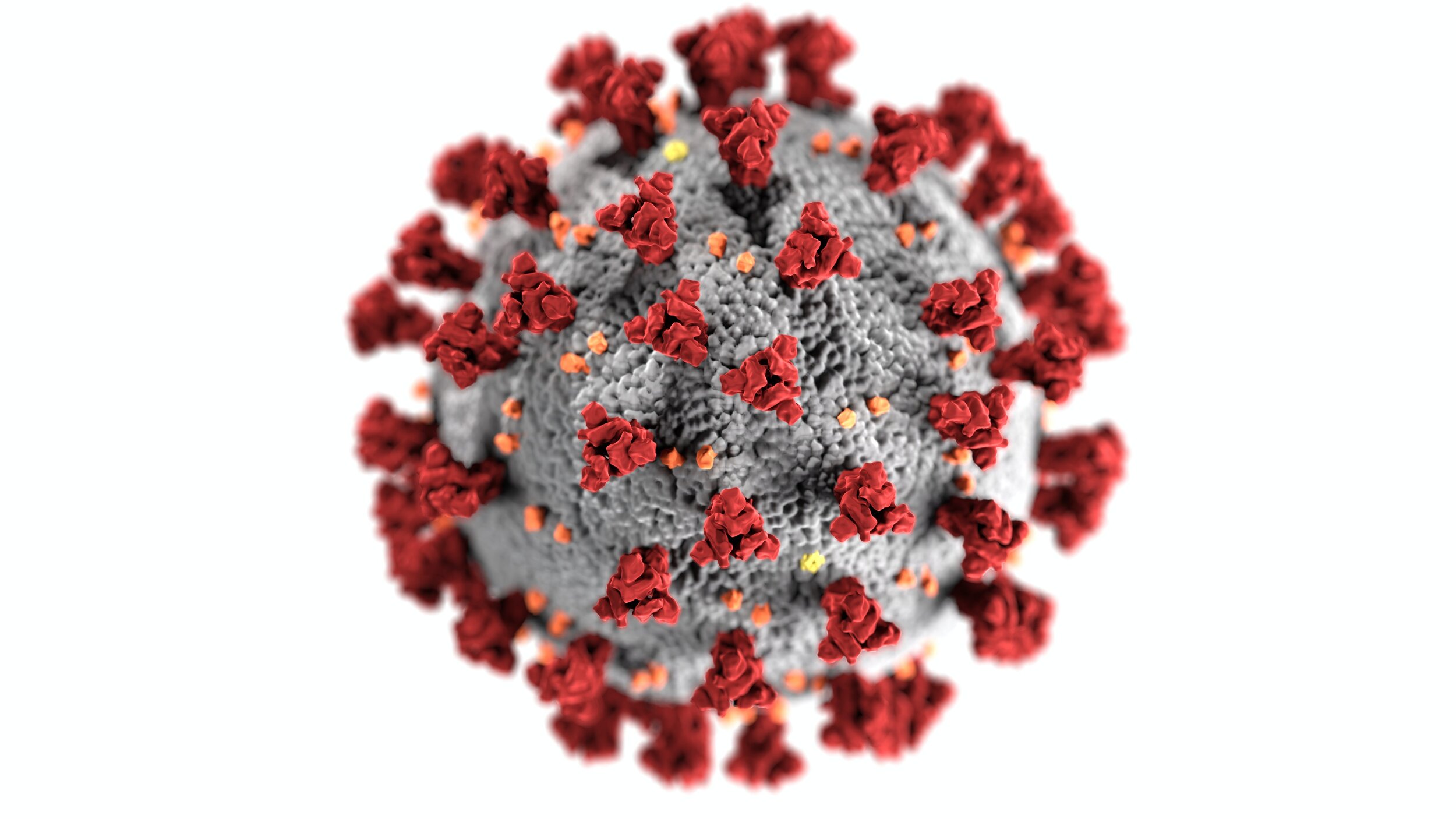

With headlines to traumatise the Irish economy such as “Covid-19: NPHET recommends State moves to Level 5 restrictions for four weeks”, it makes me think of something my business mentor told me, about borrowing money when you don’t need it & being ready for unexpected situations. Let’s look in to it?

How much working capital does a small business need?

The amount of working capital a small business needs to run smoothly depends largely on the type of business, its operating cycle, and the business owners’ goals for future growth. However, while very large businesses can get by with negative working capital because of their ability to raise funds quickly, small businesses should maintain positive working capital figures.

Assuming you passed the debt-service ratio test, when should you borrow money for your business?

You should borrow when you are confident that you can make more profit as a result of borrowing money. Estimate what your sales and profits are before borrowing and what they will be after you borrow.

What is a good debt-service ratio?

A debt-service coverage ratio of 1 or above indicates that a company is generating sufficient operating income to cover its annual debt and interest payments. As a general rule of thumb, an ideal ratio is 2 or higher. A ratio that high suggests that the company is capable of taking on more debt.

In times of uncertainty or when a business really needs money is generally the time when underwriters will class the situation as high-risk and decline an application / apply a higher rate. That’s why businesses need to be sufficiently financed to handle shocks. Hopefully that working capital comes from retained earnings however, there are times when you will need that from supports, grants or debt. Always speak with your CFO or accountant to advise you on what’s right for your situation. There are a number of government-backed supports you can read about in our post here. Or if you want to look at fast finance quotes from alternative lenders we can assist. You can get an idea of the different loan types in our post here. We’re here for you 7 days to talk finance on 01 55 636 55.

References:

https://www.irishtimes.com/news/ireland/irish-news/covid-19-nphet-recommends-state-moves-to-level-5-restrictions-for-four-weeks-1.4371810

https://corporatefinanceinstitute.com/resources/knowledge/finance/debt-service-coverage-ratio/

https://www.investopedia.com/ask/answers/102915/how-much-working-capital-does-small-business-need.asp